Introduction

By the end of June 2023, companies applying the real use VAT deduction method (cost allocation) for mixed taxable persons had to notify it to the Belgian VAT authorities. Now these companies also have to communicate a whole set of information to back-up this VAT deduction methodology.

For VAT taxable persons that already applied real use VAT deduction method before 2023 |

Option in form 604B before June 2023 (Is it done ?)> In the VAT return of the first quarter on 20 April 2024 at the latest for quarterly VAT taxable persons > In the VAT return of May on 20 June 2024 at the latest for monthly VAT taxable persons |

For VAT taxable persons that applied real use method as of 2023 |

Option in form 604A/B> In the VAT return of the first quarter on 20 April 2024 at the latest for quarterly VAT taxable persons > In the VAT return of one of the first three month of 2024, for monthly VAT taxable persons at the latest on 20 April 2024 |

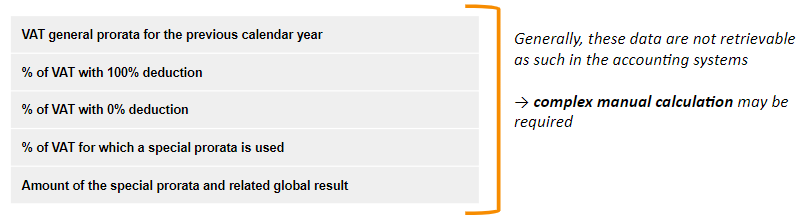

Which information to communicate

Furthermore, it is important to mention that mixed VAT taxable persons applying the general prorata as VAT deduction methodology will also need to notify the Belgian VAT authorities before 1st of July 2024 (ie. these companies will also have to communicate some information in this respect).

The VAT authorities specifically mentioned that the VAT deduction methodology applied by mixed taxable persons will be under more scrutiny. This will be facilitated by the fact that they now have a centralised database containing the VAT deduction applied by all companies using the real use method/general prorata. This will enable the VAT authorities to carry out audits more efficiently and in a more targeted manner.

Many holding companies deduct VAT on the basis of real use method, so they will be directly affected by the new measure and should be prepared for it. Here are some common errors that we see:

- Is the VAT deduction method applied correctly and is it updated and reviewed annually?

- Has the VAT deduction methodology changed as a result of a change of activity, reorganisation or control?

- Is the VAT deduction methodology still defendable or are there any weaknesses?

We are available to discuss this and to help you comply with these obligations.

- Lionel Wielemans, PwC Director (+32 477 698479)

- Quentin Motteu, PwC Sr. Manager (+32 499 776347)