The current upward trend in interest rates within the financial markets and the associated rise in borrowing costs can have a significant impact on the (intercompany) financing structures across MNE groups. From an arm’s length perspective it is essential that the terms and conditions of the intercompany transactions reflect third party dealings and market circumstances Stay informed and adapt strategically!

Market observations

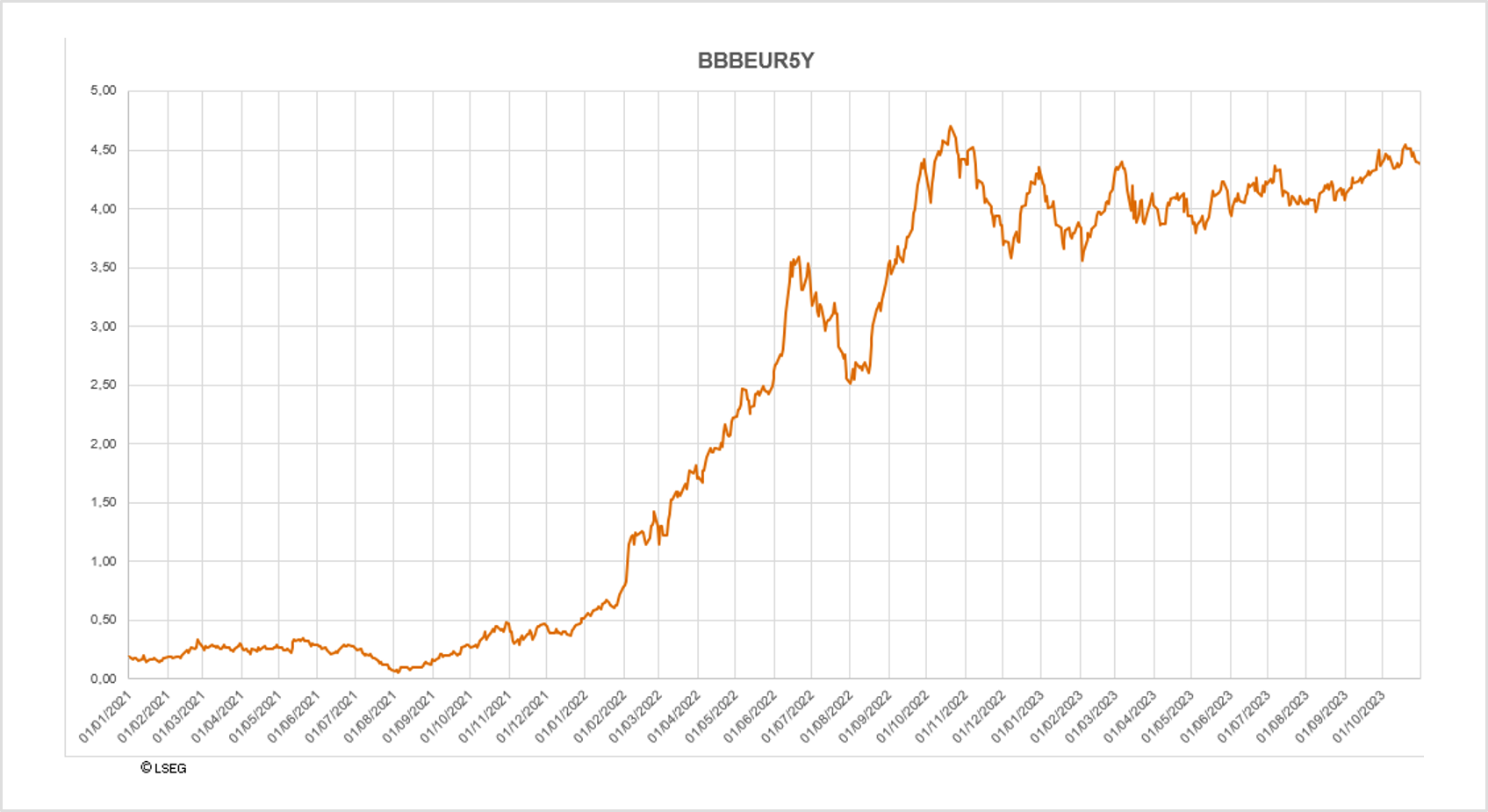

A 4.2% increase in interest rates in less than 2 years (2021-2023)

Source: LSEG database

This graph outlines the evolution of the interest rates (i.e. BBB credit rating, 5-year maturity) soaring from January 1, 2021 (0.2%) till November 1, 2023 (4.4%)

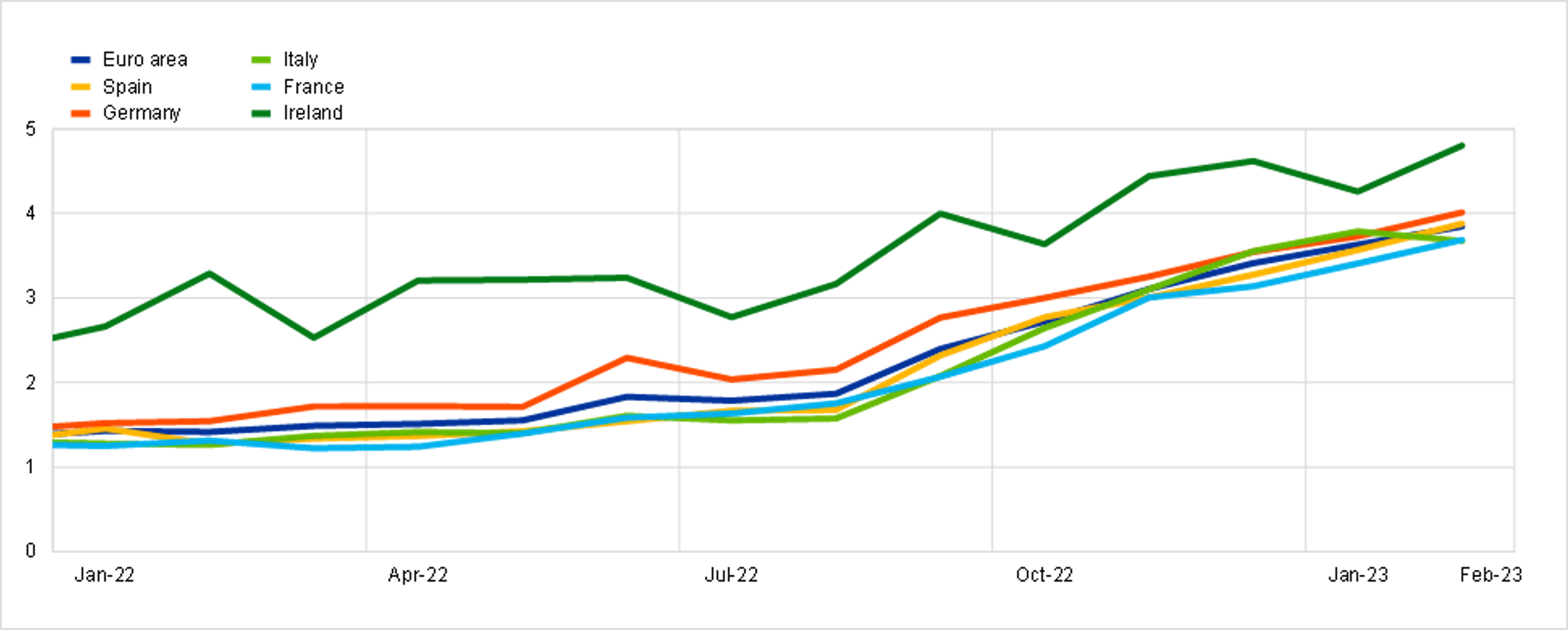

ECB observation: Increase in cost of borrowing for firms in Euro area (percentage per annum)

Source: ECB (MIR)

Key takeaways and considerations

- Have a critical look at the interest rates applied to intra-group loans given the increased cost of funding, ensuring that financing entities, such as treasury centers, do not structurally incur negative spreads.

- Verify the interest rates for deposits and borrowing in the cash pool and assess the balances and options realistically available to cash pool participants. It is vital to substantiate that being cash pool participants is still the most favorable option to avoid potential scrutiny by tax authorities.

- It is relevant to verify and document the debt capacity of borrowers. The rising interest rates directly implies increasing financing costs, typically leading to reduced capacity for the borrower to meet debt obligations.

- Assess the impact on mechanical interest limitation (30% EBITDA) to anticipate non-deductible interest.

- Assess the applicable terms and conditions in the legal loan agreements, more specifically early repayment / refinancing options, and decide whether to reprice or amend any terms to mitigate the impact of the increased market rates.