This Newsflash highlights significant measures that influence the landscape of the Belgian real estate market.

Indeed, on 9 October 2023, the Belgian government reached an agreement regarding the Federal Budget for 2024. The current budget round was an important one, as the economic climate is deteriorating and this has an impact on the budget of the government. This budget needed to find additional funds. Now that the texts are published (Draft Program Law of 28 November 2023), we would like to share an update on the upcoming measures. It is expected that the draft law will be enacted very soon.

Furthermore, we include an update on recent case law with respect to the question on the application of a treaty benefit and the notion of beneficial owner, which confirms the increased focus by the Belgian tax authorities on the concept of beneficial ownership.

1. Increase of the registration duties rate applicable on the granting of long-lease rights or building rights from 2% to 5%

This measure fits perfectly in the continuous search for closing the gaps in the Federal Budget, for which real estate transfer taxes are often targeted (remember the increase from 10% to 12% in Flanders as from 1 January 2022)

The Belgian real estate market is known for having a heavy transfer tax on direct transfer of Belgian real estate (12% in Flanders, 12.5% in Brussels and the Walloon Region). In this framework, leasehold arrangements have generated substantial favour over the past few years. This preference of a long lease right over the acquisition of the full property is that the transfer tax is reduced to 2% (5% as from 1 January 2024) whilst the long lease right is a right in rem which grants full use and enjoyment of the immovable property.

The increased rate of 5% is applicable to authentic and private deeds in relation to long-lease or building rights drafted after 1 January 2024. For deeds executed before that date, the rate of 2% will still remain if the date of submission can be proven.

Although the reduced rate with respect to registration duties is clearly a financial advantage for investors, one should take into account that the owner of a long-lease right or a building right does not have the full ownership of the asset, meaning that the assets at hand are a bit less liquid for divestment purposes.

For completeness’ sake, we understand that no changes are currently envisaged to the registration duties due on the registration of regular lease contract which will remain subject to a registration duty of 0.2%.

The increase from 2 to 5% (for long lease right) vs. the 12.5% ((12%) will clearly have as consequence that the arbitrage between both will be more debatable.

2. Additional tax of 10% for REIFs (FIIS/GVBF)

Upon entering the specific taxation regime of REIFs, an exit tax of 15% is due. An additional tax of 10% will be due due to the introduction of a new minimum five-year “standstill” period. This 10% additional tax will apply in case:

- the REIF is not listed anymore on the REIF-list as published by the FSMA within a period of 5 years since its registration on said list; or

- shares in the REIF, which were acquired following a contribution in the REIF, are sold within a period of 5 years since the shares were acquired.

This measure is set to take effect on 1 January 2024. Based on the reading of the draft law, the provision also extends to companies that transitioned to a REIF before 1 January 2024 but fail to meet the 5-year requirement after 1 January 2024. It should be mentioned that the triggering factor is the 5-year period, independent of the timing of the transition from a company to a REIF, whether it occurs before or after 1 January 2024.

We do not expect major consequences arising from this anti-abuse measure.

3. Non-deductibility of subscription tax or net asset tax

Regarding subscription costs, the Belgian government has targeted two recent changes. This includes an adjustment to the deductibility of the net asset tax. The asset tax is set at 0.0925% for REITs and 0.01% for REIFs respectively and is calculated on the total of net assets placed in Belgium (i.e. not applicable to the extent the REIF is held by non-resident shareholders).

Under the provisions of the Program Law enacted on 26 December 2022, the subscription tax is incorporated into the taxable basis of a REIF/REIT. For Belgian tax purposes, only 20% of the subscription tax is eligible for deduction as a professional expense. In other words, 80% of the subscription tax is not considered as tax deductible expense and is consequently deemed a disallowed expense. This is an important aspect that must be taken into account as the taxable basis of a REIF (FIIS/GVBF) and REIT (SIR/GVV) is favourable due to its limited taxable basis. This basis includes abnormal and gratuitous benefits as well as disallowed expenses. Therefore the non-deductible part of the subscription tax will be included in the taxable basis of the FIIS.

Based on the draft Program Law of 28 November 2023, the reference to ‘80%’ will be eliminated, meaning the full exclusion of the subscription tax from tax deductible expenses as from 1 January 2024. This means that this new measure becomes applicable as of the assessment year 2025 (i.e. financial year starting on 1 January 2024).

The question naturally arises as to whether this measure might reopen discussions on tax-on-tax matters. It’s worth noting that a similar debate occurred in the past regarding the corporate income tax burden itself.

4. VAT changes

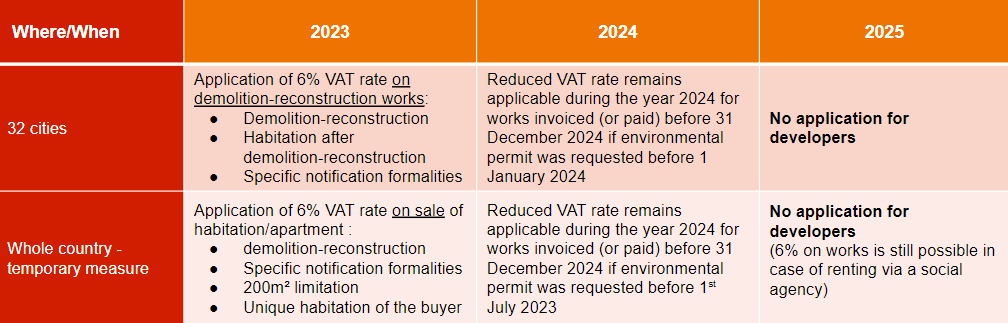

6% VAT rate on demolition-reconstruction of habitation in 2024 for developers

The government decided to limit the application of the 6% VAT rate to projects carried out by private individuals. Developers will therefore not be able to benefit anymore of this advantage. A transitional period is foreseen for 2024.

Developers must review their projects portfolio in order to assess the VAT treatment applicable and the financial impact.

- What is the timing of the works and delivery ?

- Communication towards purchasers ?

- What can be invoiced in 2024 (Breyne law) ?

VAT deduction: formalities

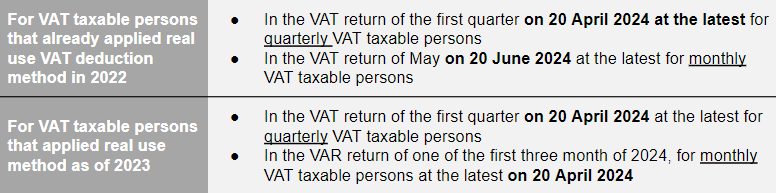

Companies applying the real use VAT deduction method

Last year new obligations were imposed to companies deduction the VAT according to the real use VAT deduction method (direct allocation of costs. This method is widely used in the real estate sector.

First companies already applying the method had to opt before 1st July 2023.

In 2024, these companies will be subject to a special VAT reporting.

Information to be communicated:

- VAT general prorata for the previous calendar year

- % of VAT with 100% deduction

- % of VAT with 0% deduction

- % of VAT for which a special prorata is used

- Amount of the special prorata and related global result

The special prorata will have to be communicated on a yearly basis. However, there is still uncertainty regarding the periodicity of reporting of the other data. Generally, these data are not retrievable as such in the accounting systems which will require some manual works.

Companies applying the general prorata to deduct input VAT

Companies using a general prorata to deduct input VAT will have to notify it before 1st July 2024. They will also communicate the provisional and general prorata in more detail in the future.

Given the increasing scrutiny on companies deducting partial input VAT, a practice prevalent in the real estate sector, it is now imperative to conduct a thorough review of your VAT deduction methodology. This step is essential to ensure compliance and mitigate the risk of audits.

5. Beneficial ownership – recent case law

A recent arrest (27 October 2023) rendered by the Court of First Instance of Leuven highlights the growing importance of the concept of beneficial owner in order to rely on a withholding tax exemption on interest. This position is in relation to the treaty benefit where the Court takes the position that even if the notion of beneficial ownership is not included in the Belgian-Dutch double tax treaty, the concept has to be interpreted according to the Interest and Royalty Directive. Indeed, as members of the EU, Belgium and the Netherlands are also obliged to ensure compliance with EU law.

In the case at hand, a Belgian company paid interest on five loans concluded with his Dutch subsidiary (BV2) and claimed the withholding tax exemption as foreseen in the Belgian-Dutch double tax treaty. More in particular, a Dutch CV initially granted five loans. Four of these loans are directed to a Dutch parent company (BV1), while the remaining one is allocated to a Dutch subsidiary (BV2). Subsequently, the loans are contributed from the Dutch CV to an LLC (Delaware incorporated company). The Dutch BV 1 and BV 2 make part of a Dutch fiscal unity.

The major issue is to determine whether the Dutch BV2 holds the status of the beneficial owner for the interest payments made by Belco. In the case at hand, BV2 does not qualify as beneficial owner of the revenues paid, the exemption under the double tax treaty can hence not be applied.

The Court asserts that the described circumstances implicitly indicate that the Dutch parent and subsidiary merely serve as formal intermediaries and, in essence, do not function as beneficial owners of the income. Consequently the Court rejected the withholding tax exemption of the double tax treaty, asserting that, according to their stance, the rightful owner of the interest payments is the LLC. As a result, the withholding tax is due on the interest payments including a gross up of the total amount (i.e. the withholding tax must be added to the amount of income for the calculation).

The beneficial ownership requirement has been increasingly used by the tax authorities, supported notably by the 2019 Danish cases of the CJEU. In the light of the above, it is expected that the tax authorities will during tax audits request the Belgian taxpayer to proof that the recipient of the movable income is the beneficial owner, and this not only in a situation of application of a withholding tax exemption based on the Interest and Royalty Directive, but also on the basis of a double-tax treaty, even if the notion is not explicitly included in the treaty. The question of beneficial ownership is clearly a priority matter for the Belgian tax authorities and we clearly recommend to launch a review of the investment structure and to prepare a defence file.

***

Your PwC Real Estate Team is there to help you to assess the impact of the above measures on your real estate investments.