Considering the exceptional business environment various corporate income tax measures have been taken to sustain the liquidity and solvability position of both resident and non-resident corporate taxpayers.

Advance tax payments

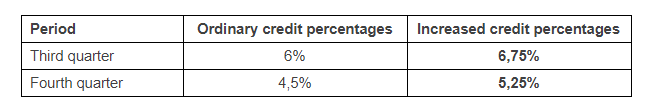

A recent circular letter of 1 September 2020 confirmed the conditions and increased credit percentages for advance tax payments that can be made in the remaining quarters in view of avoiding or reducing a corporate tax surcharge. The temporary measure is only applicable to corporate taxpayers closing their taxable period between 30 September 2020 and 31 January 2021. Furthermore, a corporate taxpayer will not be entitled to higher credits if in the period starting 12 March 2020 until the last day of the taxable period:

- own shares are acquired;

- a capital reduction is processed;

- dividends are paid or attributed;

For listed companies an additional condition is applicable, no bonuses (variable remuneration) can be paid to defined company officers between 12 March 2020 and the last day of the taxable period.

Companies with a direct participation in a company registered in a country qualified as a tax haven are excluded. If payments equal to or exceeding EUR 100,000 are made to a company in a tax haven jurisdiction the higher credits are only applicable if it is proven that the payments were made as part of genuine, proper transactions meeting economic or financial needs.

For companies with a calendar year-end, the third and the fourth quarterly due dates are respectively 12 October 2020 and 21 December 2020. Through this measure companies that did not make any advance tax payments yet have now still the opportunity to avoid an increase if they make a Q3 advance tax payment that equals the anticipated tax liability for the taxable period.

Our experts are ready to assist you in:

- Computing and optimizing the advance tax payments to be made for assessment year 2021 taking into account the further roll-out of the tax reform (such as the interest limitation deduction or the tax consolidation regime); and/or

- Providing further guidance on how to access/use the specific module on the MyMinFin platform; and/or

- Analysing the impact of the supportive financial measures resulting from the COVID-19 and, if applicable, we can also assist with the actual preparation and filing of the formal request.

Reception costs temporarily 100% deductible

To support the “horeca and entertainment sector”, the government decided that reception costs incurred for business purposes between 8 June 2020 and 31 December 2020 are 100% deductible. The usual business relationship gifts are excluded and do not benefit from this measure, they remain 50% deductible.

Improved investment deduction

Another measure encourages ongoing investments through a temporary increase of the investment deduction. For qualifying “small” companies, the rate is increased to 25% for new fixed assets, directly linked to the economic activity, actually acquired or produced between 12 March 2020 and 31 December 2020. Whilst the transfer of the ordinary investment deduction in absence of a (sufficient) taxable basis is only possible to the next taxable period, it has recently been decided that for the assets originating in 2019, the transfer possibility is extended with another year till the second year following the investment.

For more insights and support

Contact your regular PwC advisor (or Tim Pieters or Karl Struyf).