Referring to our newsflash of 3 September 2021, we remind you that the new reporting obligation for companies to report the actual amount of costs proper to the employer that are reimbursed on the basis of supporting documents is applicable since 1 January 2022.

Principle

Based on the circular letter 2021/C/20 (employer interventions for home working) and on the law of 27 June 2021 (introducing the obligation to report the amount of variable cost reimbursements), all allowances paid to employees (as from 1 January 2022) as reimbursement of costs incurred by the employee/director in the framework of the business activity must be justified in the individual tax forms (281.10/281.20) for their actual amount (real value). Most likely, the objective of the legislator is to enable tax inspectors to verify whether the costs reimbursed on the basis of the expense reports are not reimbursed twice (on a lump-sum basis and based upon expense notes).

Current Legislation

The employer can choose to reimburse the costs incurred by the employee while performing their duties after submission of the necessary supporting documents by the employee. Alternatively, the employer can determine these reimbursements on a (lump sum) fixed basis.

Irrespective of the reimbursement method, reimbursements paid as of 1 January 2022 must always be reported for the full and total amount on the tax forms. This is new and applies to all reimbursements (fixed or variable) of costs proper to the employer.

On the salary slips, three boxes will be mentioned:

- Cost reimbursement on the basis of supporting documents

- Lump-sum reimbursement based on serious and consistent standards

- Lump-sum reimbursement not based on serious and consistent standards

If the amount of the fixed reimbursement is determined according to serious standards that are the result of repeated observations and spot checks, these reimbursements can be put under ‘lump-sum reimbursement made based upon serious and consistent standards’ (i.e. category 2).

Determining the qualification of category 2 (lump-sum reimbursement that is based on serious an)d consistent standards) or 3 (lump-sum reimbursement that is not based on serious and consistent standards , comes down to the definition of ‘serious standards’. This notion of ‘serious standards’ has however not been defined in the regulations to date. It is however accepted that the following allowance are based upon serious and consistent standards:

- The lump-sum allowances that the government itself grants to its civil servants. The pre-eminent example is the lump-sum kilometre allowance for business travel. But also, for example, the daily allowances for domestic and foreign business trips fall under this heading.

- Lump-sum allowances laid down in legal sources like Circular letters e.g. the home office allowance that is provided for in the Circular Letter 2021/C/20

- Lump-sum allowances confirmed in a Tax Ruling

- The fixed allowances that have been worked out by the employer on the basis of a sufficiently substantiated file that evidences that the allowances correspond as closely as possible to the real costs that are incumbent to the employer and that are borne by the employee. Ideally, the employer does this exercise at regular intervals.

The conclusion of the above is, that the reimbursement of cost allowances, be it based upon expense notes or based on lump sum payment is more and more on the radar of the authorities. Hence, 2022 is a good momentum to perform a review of your cost allowance reimbursements. Reach out to your PwC representative. He or she can help you.

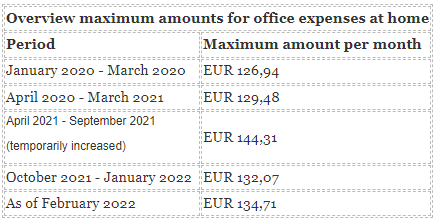

Last but not least, please find below an updated table showing the amount that can be reimbursed free from tax and social security to cover office expenses at home. Currently, the fixed monthly amount for office expenses has been increased by the NSSO and adapted in its instructions. In a Circular letter, the tax authorities have confirmed these amounts. (Circ. 2022/C/12 on employer interventions for home working). Please find below an overview of the maximum amounts that are accepted by the authorities.

In case of any further questions, please do not hesitate to contact Christiaan Moeskops.