On 30 October 2020 a new version of the Combined Nomenclature for 2021 (also known as “the Tariff”) has been published in the Official Journal of the European Union. The Tariff is used for the classification of the goods for imports and trade between the EU member states (i.e. Intrastat). The new version of the Tariff will enter into force on 1 January 2021.

On an annual basis, Annex I to Council Regulation (EEC) No 2658/87 on the tariff and statistical nomenclature and on the Common Customs Tariff is updated by the European Commission. This Annex is commonly known as the EU Combined Nomenclature or simply “the Tariff”. These updates vary from adding/removing CN codes, changing the description of the CN code to changing the existing CN code for a product without changing anything else about the application of the CN code.

What does this mean for your business?

In the next paragraph the CN codes subject to changes for 2021 can be found. What does this mean for your business? As mentioned, the Tariff is used for the classification of the products. As the changes can have an impact on this classification of the products and therefore have an impact on your business, it is important to verify whether these changes do apply to your business.

It is recommended to timely evaluate the effects of the changes (e.g. change of a customs authorisations which includes specific commodity codes, master data in systems to be updated) to prevent any surprises, delays and incorrect declarations being filed as of 1 January 2021.

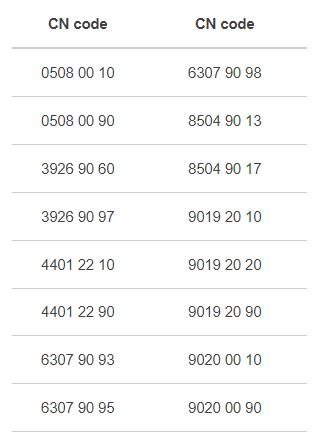

Changes in the CN 2021

In the overview the CN-codes have been included which have been added or changed for the Tariff of 2021. This concerns products like red coral, protective face shields/visors, wood in chips or particles, mechanical ventilation apparatus, gas masks. The legal texts are available in French, Dutch and English.

Let’s talk

In case you need any advice on this matter or require our assistance, please contact your regular contact at PwC.