The past few years the financial markets have been characterised by a significant increase in interest rates battling the surge in inflation throughout the world.

Since the arm’s length principle requires intercompany transactions to appropriately reflect current market conditions, these exogenous elements have led companies to update their financing policies and more specifically their transfer pricing policies to accommodate these financial market dynamics.

However, now that both the European Central Bank (“ECB”) and the United States Federal Reserve (“FED”) have instituted a key interest rate cut, it seems the 2-year lasting interest rate hike has finally come to an end (and may be partly reversed).

These new developments may yet again impact the long-term financial positions (and policies) of multinational groups.

Market observation

- In June 2024, the ECB announced that it would lower the interest rate with 25 basis points, followed by a second ECB deposit rate cut of 25 basis points in September 2024.

- Whereas the FEB initially was reluctant to follow the intervention of the ECB, it also has now implemented its first key interest rate cut since 2020 with no less than half of a percentage.

- At the same time, the ECB is now evermore closing in on its targeted long term 2% inflation rate for the first time since mid-2021. Keeping in mind the ECB’s earlier expressed belief that “it will keep policy rates sufficiently restrictive for as long as necessary to achieve [2% medium-term target]”, the second interest rate cut was anticipated by several experts.

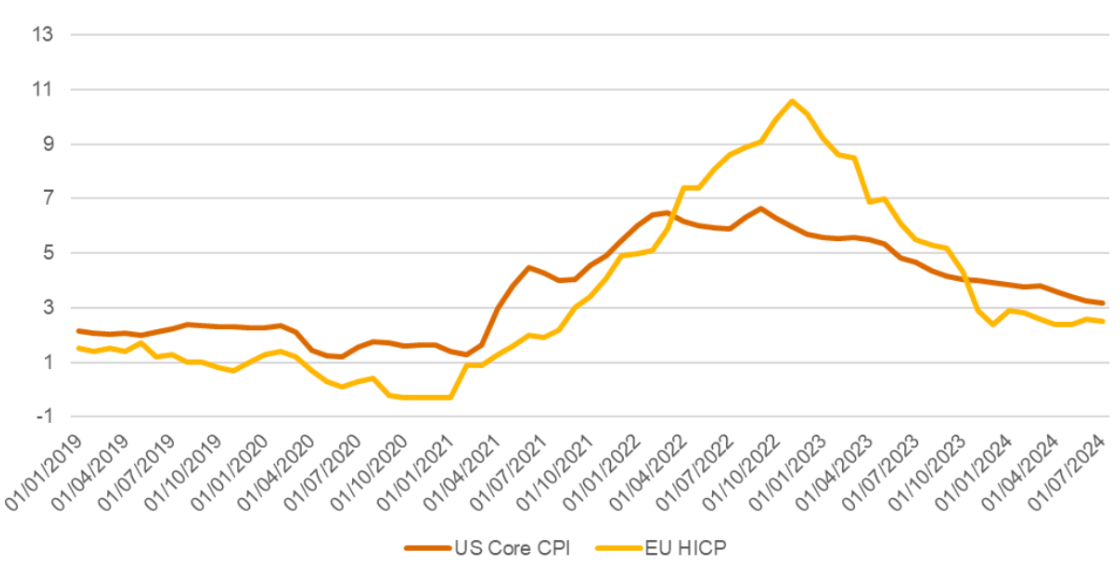

- These beliefs are further strengthened by the empirically observed inflation rates in these markets as shown below:

Source: ECB Data Portal, Series key ICP.M.U2.N.000000.4.ANR and FED Cleveland, Inflation Charting. The US Core Consumer Price Index (“CPI”) measures the average change over time in the prices urban consumers pay for a market basket of goods and services, excluding food and energy due to their price volatility. The EU Harmonised Index of Consumer Prices (“HICP”) is a standardised measure of consumer price inflation across EU member states, used by the ECB to monitor inflation and assess price stability in the Eurozone.

The current economic climate and expectation of decreasing interest rates and lowering inflation may, through the transmission effect and longer term expectations of market participants, ultimately render external loans again more attractive as a source of funding. This may also be further strengthened by banks’ increasing willingness to lend.

When compositing the preferred funding mix, several considerations on transfer pricing policies should be made as summarised below.

Potential impact on transfer pricing policies

- Falling inflation typically goes hand in hand with lower interest rates, which is evidenced by the key interest rate cuts by both the ECB and the FED. As a consequence, the cost of borrowing on the financial market is expected to decrease in the times to come. In light of this reduced cost of borrowing, it will be crucial to evaluate the impact on existing financial transfer pricing methodologies which may be impacted by these reduced interest rates. This may for example apply when (part of) your transfer pricing model is based on direct links to (an) external financing transaction(s), characterised as a comparable uncontrolled transaction, which may become due for revision/refinancing.

- ECB’s most recent “SAFE” survey shows that banks are prudently becoming more willing to lend, increasing the accessibility of loans for companies. Hence, in-house banks and financing entities might be able to more easily and/or more advantageously obtain external financing, as external banks are prompted to ease lending criteria and extend more credit to corporations in order to support the overall economy. As a consequence, in-house banks might see various risks (such as their liquidity risk) lowered, as they are able to secure external funding more easily and potentially at more favourable conditions. By achieving a lowered risk profile, international groups might also start to exhibit a lower credit risk profile, which is a key determinator within the calculation of an arm’s length interest rate.

- Companies that have existing loans outstanding dating from periods of higher inflation and interest rates may identify opportunities to refinance their debt under better terms. Refinancing can lower interest costs and improve cash flow, giving businesses more financial flexibility. This can be a strategic move for international groups as a whole, as well as for individual entities within a group, aiming to optimise their debt structures and enhance financial stability. However, it’s equally important to consider intercompany financing transactions during refinancing. While an external loan might be successfully refinanced, an internal loan might not be repaid as easily (as different terms and conditions may apply), which could put pressure on the financing entity’s returns.

- While lower interest rates and increased loan accessibility present numerous opportunities, companies must exercise caution to avoid surpassing their debt capacity. The allure of cheap credit can lead to excessive borrowing, which may become problematic if economic conditions change or if interest rates rise in the future, especially in case external financing would be concluded on a floating rate basis. Prudent financial management with some scenario, a balanced mix of debt and equity and sensitivity analyses are essential to maintaining long-term financial health and ensuring that a company’s debt capacity is not exceeded.

Key takeaway

- The atypical and highly unpredictable conditions characterising the financial markets the past years seem to have eased down as both the FED and the ECB have initiated interest rate cuts in September 2024. Corporations should be cautious of these stabilising market trends, as they can impact the intercompany financing on various levels.

More news about

- Accounting and Tax Compliance

- Base erosion and profit shifting (BEPS)

- Corporate income tax

- Financial Services Tax & Regulatory

- Insurance banking

- International taxation

- Tax Accounting

- Tax controversy and dispute resolution (TCDR)

- Transfer pricing