On 25 November, the European Commission published a proposal amending Regulation (EU) 2015/760 on European long-term investment funds (ELTIF). It is published together with a series of documents, including an Impact Assessment Report.

Context of the proposal

The ELTIF regulatory framework was adopted in 2015 and created a new investment fund vehicle intended to facilitate long-term investments in a wide range of assets by professional and retail investors, and provide an alternative, non-bank source of finance to the real economy. Such long-term finance can support the development of the European Union’s economy along the path of smart, sustainable and inclusive growth.

However, the regime did not have the intended success. As of October 2021, there were only 57 ELTIFs in the EU, approximating a total of assets under management of about EUR 2.4 billion, representing a tiny fraction of the total EU AIFs market (EUR 6.8 trillion as at the end of 2020). These ELTIFs are located in a limited number of jurisdictions (France, Luxembourg, Italy and Spain) and their portfolio composition is skewed towards certain eligible investment categories. These underwhelming results led the European Commission to submit a proposal to make the regime more appealing to investors and fund managers alike.

What are the proposed changes?

Broadened scope of eligible assets and investments

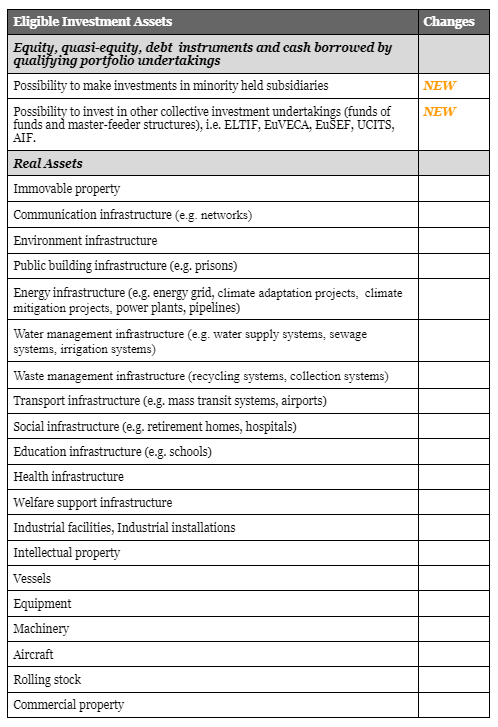

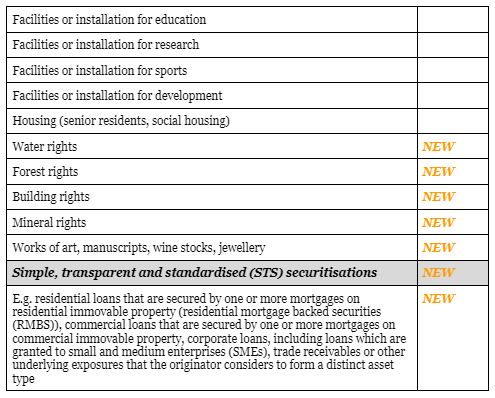

The definition of “real asset” under the proposal has been broadened to include any asset that has an “intrinsic” value due to its substance and properties, without anymore requiring that such asset provide investment returns or predictable cash flow. As a result, it may now also include assets that cannot be easily quantified, and rights attached to or associated with real assets.

Furthermore, the minimum investment in a real asset by the ELTIF has been lowered from EUR 10 million to EUR 1 million, thus making this class of investment much more accessible.

ELTIFs, which originally could only invest in other ELTIFS, EuVECAs and EuSEFs, are now also allowed to invest in AIFs investing in eligible investments under a “look through” approach.

Furthermore, the market capitalisation threshold for listed qualifying portfolio undertakings is raised from 500 million to 1 billion EUR, to be assessed solely at the time of the initial investment.

Lastly, ELTIFs are now also allowed to invest in eligible securitizations, which include commercial, residential and corporate loans as well as trade receivables.

ELTIFs may now make minority co-investments in investment opportunities and are no longer required to invest via or in ‘majority owned’ subsidiaries. That possibility should enable ELTIFs to obtain additional flexibility in implementing their investment strategies, to attract more promotors of investment projects and to increase the range of possible eligible target assets, all of which is essential for the implementation of indirect investment strategies.

Hereafter, you will find a non-exhaustive summary of eligible investment assets categories as understood from the proposal.

More flexible concentration and diversification requirements

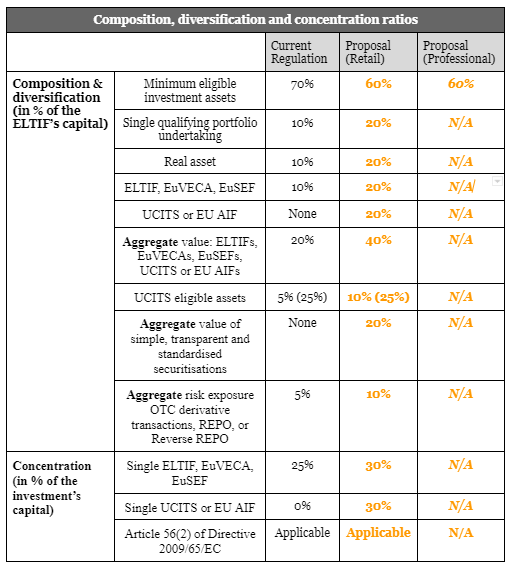

The minimum percentage of its capital that an ELTIF must invest in eligible investments is lowered from 70% to 60%.

The maximum of its capital that an ELTIF may invest in a single (a) qualifying portfolio undertaking, in any (b) ELTIF, EuVECA, EuSEF, EU AIF, UCITS or in any (c) single real asset is raised from 10% to 20%.

Additionally, the maximum aggregate value of units or shares of ELTIFs, EuvECAs, EuSEFs and AIFs in an ELTIF portfolio is increased from 20% to 40%.

The aggregate value of securitizations in an ELTIF portfolio can henceforth amount to 20% of the total value of an ELTIF.

Lastly, the concentration of shares of a single ELTIF, EuvECA or EuSEF that an ELTIF may possess is increased from 25% to 30%.

Differentiation between ELTIFs marketed to retail or professional investors

Under the proposal, much lighter requirements apply to ELTIFs which are solely marketed to professional investors. This will provide much more flexibility in terms of investment strategy for the managers of ELTIFs designed for professional investors.

Increased leverage

On the one hand, the limit of cash borrowing (leverage) is increased from 30% to 50% of the value of the ELTIF’s capital for retail ELTIF. On the other hand, this limit is increased to 100% for ELTIFs solely marketed to professional investors.

Furthermore, the borrowing of cash no longer needs to be made in the same currency as the currency in which the ELTIF acquires its assets, so long as it has been hedged. It is also clarified that the encumbering of assets is permitted where it is sought to implement the borrowing strategy, and the 30% predefined fixed limitation is lifted.

Fund-of-Funds and Master-feeder strategies

The fact that ELTIFs are now allowed to invest in AIFs and UCITS facilitates the implementation of fund-of-funds strategies, thereby offering a common and very effective way of obtaining rapid exposure to illiquid assets, in particular in respect of real estate and in the context of fully paid-in capital structures.

An ELTIF can now also make use of master-feeder structures by investing at least 85% of its assets in a “master” ELTIF. Disclosure requirements apply (structure, remuneration, costs payable, tax implications).

New optional liquidity window mechanism

ELTIF managers now have the possibility to create an optional liquidity window mechanism aimed at providing, before the end of the ELTIF’s life.

In other words, any investor who wishes to sell his shares may inform the fund manager, who can match this exit request with entry requests by other investors. This new mechanism is intended to foster the adherence of retail investors, whom the inherent illiquid nature of ELTIFs might stall.

Relaxed marketing requirements for retail investors

Originally, if ELTIF managers wished to directly market their product to retail investors, they had to comply with a series of requirements. Specifically, they had to obtain information related to the investor’s knowledge and experience in the field of investment, his financial situation and investment objectives.

Furthermore, the manager was required to put in place facilities for making subscriptions, payments and redeeming of units in each Member State where he intended to market an ELTIF to retail investors.

These additional layers of administrative burdens are repealed considering they lead to higher costs for retail investors, disincentivized ELTIF managers from offering new ELTIFs to retail investors and added to already existing requirements for AIFs.

Tax aspects

While the granting of a beneficial tax treatment to the ELTIFs as for similar national schemes is obviously a prerequisite for the success of ELTIFs in a given Member State (e.g. Art. 185bis ITC92 as regards Belgium), the Impact Assessment Report identifies a series of other tax aspects relevant to increase uptake of ELTIFs across the EU: (a) access to double tax treaties issues due to the ELTIFs beneficial tax treatment in the MS where they are established and in respect investors residence or nationality requirements, (b) inconsistent and burdensome withholding tax recovery procedures, (c) diverging national fund tax reporting requirements which discourage (retail) investors from investing cross-border.

These taxation barriers are not ELTIF-specific, but are of course relevant for the whole EU asset management industry and are the subject of other Commission work streams.

The Report also acknowledges that the presence of tax incentives may influence the design or marketing to a specific category of investors who may find it attractive to invest in a product due to a combination of economic, financial and investment aspects.

What are the next steps?

The proposal is now open for feedback for a minimum period of 8 weeks.

The Commission’s proposal then needs to be approved by both the European Parliament and the Council. Both of these bodies have the ability to amend the text, which can be sent back and forth between them several times.

Once approved, the text shall be directly applicable without the need of further implementation by the EU Member States.