Recent data published by the European Central Bank (“ECB”) indicates that the volume of short-term deposits made by non-financial companies (“NFCs”) in the euro area is reaching its peak. Similar trends are observed from the intra-group perspective, when international groups opt for an internal cash pool as one of the cash management solutions. In order to comply with transfer pricing regulations, the cash pool leader must be correctly remunerated.

Market observation

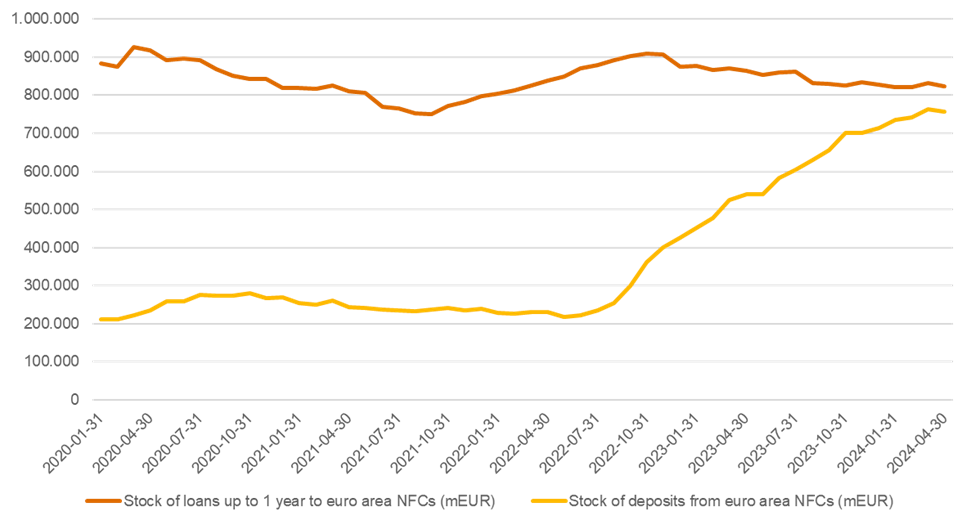

Over the past years, non-financial corporations are increasingly opting to hold excess cash readily available, in order to obtain increased flexibility in their operations and investments. Such a change in behavior is supported by various market insights and data showing that the interest in short-term deposits and instruments is significantly growing (driven alongside by interest rates spikes). In particular, starting in the second half of 2022, euro area monetary financial institutions noted a steep rise in volumes deposited by NFCs for the short term, whilst the volumes borrowed through short-term loans have remained relatively stable. Similarly, this trend can equally be observed in the intra-group landscape, where international groups might opt to deposit their excess cash internally with an affiliated cash pool leader.

Source: ECB Data Portal, Series key BSI.M.U2.N.A.A20.F.1.U2.2240.EUR.E and Series key BSI.M.U2.N.A.L22.L.1.U2.2240.EUR.E.

A surge in deposits in an intra-group context, alongside with the reality of the drastically increased interest rates over past few years might trigger additional scrutiny from tax authorities, who might challenge the interests due to the cash pool participants on deposits, the fact that subsidiaries deposit very significant amounts in cash pool structures, and ultimately allocation of the overall cash pool synergies. For the latter, the functional profile of the cash pool leader plays a crucial role.

Functional profile of the cash pool leader

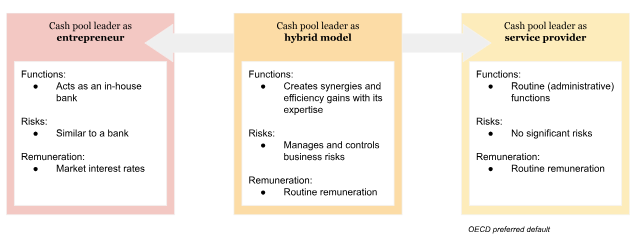

The functionality of an affiliated cash pool leader can vary from an in-house bank (entrepreneur) to service provider and anything in between. In the first end of the continuum, the entrepreneurial cash pool leader creates value to the group by managing the financial cash position of the group and actively participating in the profits / losses stemming from these activities. Respectively, the entrepreneurial cash pool leader will have decision-making power and control over risk capacity similar to those that an unrelated bank would have in the similar conditions. On the other side of the continuum, the cash pool leader will operate as a simple service provider, providing merely administrative support to the cash pool participants. Since the cash pool leader does not manage and assume any significant risks in this case, its remuneration will be limited to a routine remuneration.

Following the widely accepted guidance provided by the OECD, a cash pool leader acts generally more as a service provider. However, this might be perceived as an invitation to tax authorities to consider this as a default position, creating a tension field with reality, where the functions performed, assets employed, and risks assumed by the cash pool leader might effectively be better aligned with a hybrid / entrepreneurial characterisation.

Cash pool pricing structures and the allocation of obtained synergies are pressured by the inherent subjectivity in the accurate delineation of the functional profile of the cash pool leader and with the significant increase in interests and volumes of the short-term deposits (as also noted in an intra-group context. A thorough analysis of the functional profile of the cash pool leader and its further proper documentation are crucial first steps in safeguarding the group’s cash pool structures against potential challenges from local tax authorities.

Key takeaways and considerations

- Recent observations show a substantial change in cash management behavior of corporates that in case of excess cash opt more for the short-term deposits. This is also observed in the intra-group context.

- Identifying the functional profile of your cash pool leader is crucial when determining cash pool synergy allocation and respective arm’s length remunerations. Tax authorities might try to challenge the functional profile of the cash pool leader in the jurisdiction of the cash pool participants in order to obtain a larger taxable base.

Contacts: David Ledure and Maxime Dessy