Executive summary

- Due to the acceleration of the electrification of the fleet, employees driving a combustion engine car were faced with an approx. 10% increase of the benefit in kind company car as of 2024.

- To mitigate the related tax cost for the individual, the Minister of Finance has announced a change in the calculation method.

- However, based on the projections for the new car market for 2024 and without any new changes to the rules, the tax increase will be even more significant in 2025, with estimates ranging to 25% increase of the tax on the benefit in kind.

Context

Traditionally, the Minister of Finance announces towards the end of every calendar year the reference CO2 emission to be used for the calculation of the benefit in kind for the private use of the company car.

The idea of this reference value, one for petrol, one for diesel cars, is to have a higher taxation of cars that are more polluting than the average new car, and a lower taxation for cars that are emitting less CO2 than the average new car of the last calendar year. For this, the average is taken from the CO2 emission norm of each newly registered car between October and September of the prior year.

In line with the continued greenification of the Belgian company car fleet, we have seen a year-over-year decline of this average. Where the average was still 130 gr/km in 2020, in 2022 this had dropped already to 105 gr/km.

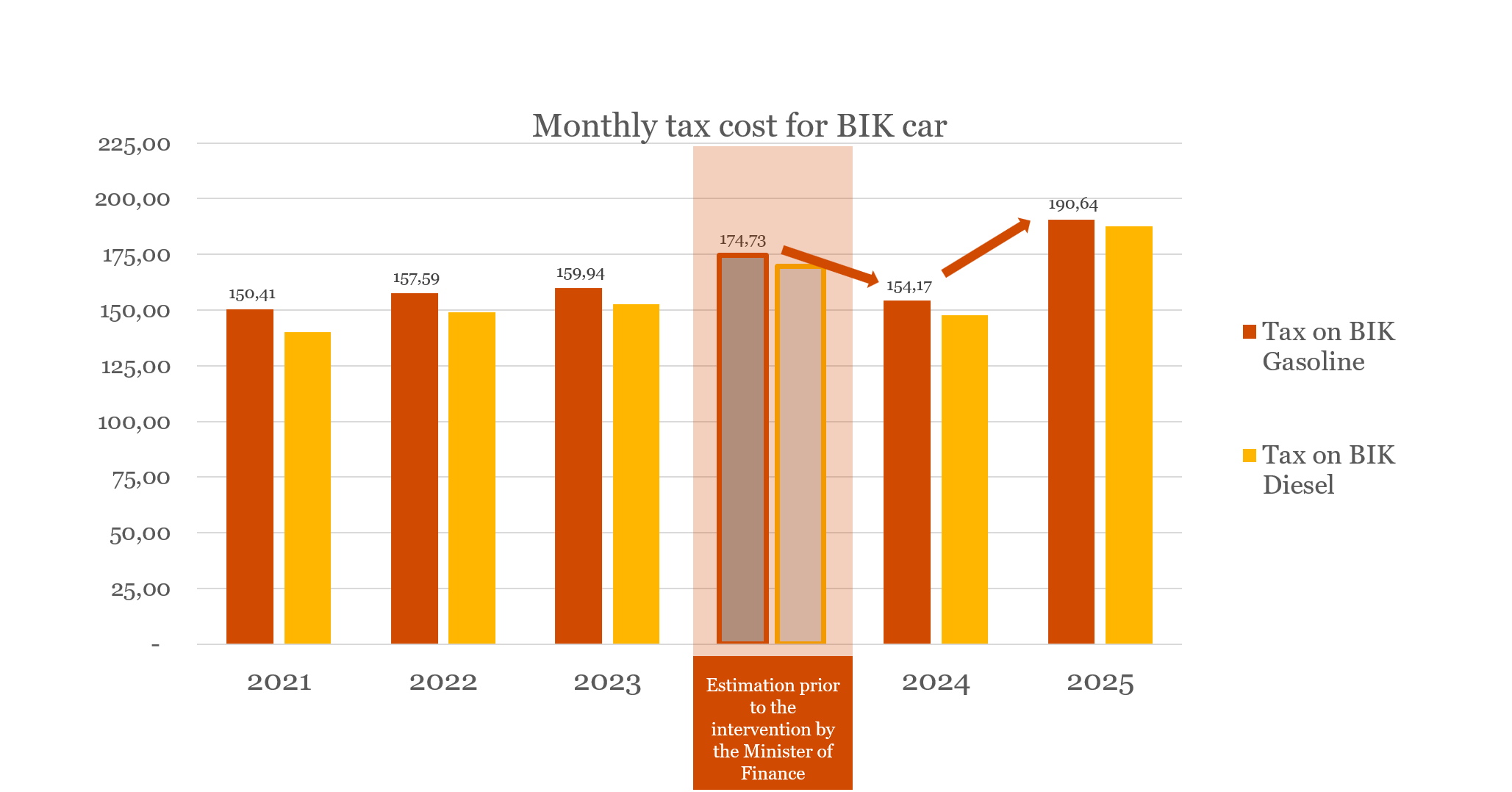

As a result, company car drivers have seen the taxes on their car steadily increase in the past years as the difference between their car and reference CO2 emission increases. For example, an employee who would receive a new petrol car in 2021 with a catalogue value of 41.000 EUR and CO2 emission of 143 g/km, would see his monthly taxes increase from approximately 150 EUR per month in 2021 to 159 EUR per month in 2023.

Update for 2024

With the important fiscal changes for non-electric vehicles in mind that entered into force on 1 January 2023 and 1 July 2023, many were anxiously looking to see how this acceleration in the greening of the fleet would impact the monthly benefit in kind.

Indeed, due to the first effects of this tax reform, the average CO2 emission of the newly registered vehicles has dropped further to 79 g/km. Although the exact calculation of the two reference values for 2023 was not shared, estimates would land the reference value for petrol (and LPG or CNG) at 62 g/km and for diesel at 50 g/km. In the aforementioned example, our employee would have to pay an additional 14,79 EUR per month for the same car, totalling to 174,73 EUR per month.

The Minister of Finance has announced to mitigate the increase in benefit in kind by referring to a different CO2 emission norm than previously used.

For income year 2024, the following CO2 emission will be applied to the above taxable benefit in kind:

- Petrol, LPG or natural gas cars: 78 g/km (instead of 82 g/km for income year 2023)

- Diesel cars: 65 g/km (instead of 67 g/km for income year 2023)

The above reference CO2 emission is effective as of 1 January 2024 and the corresponding benefit in kind should retroactively be processed in the January payrolls. As most January payrolls have been processed in the meantime taking into account the 2023 reference-CO2, a rectification will appear on your February-payslip.

As a result, our employee in the example would actually see the monthly tax slightly decreasing with 5,77 EUR (due to the 6% depreciation of the catalogue value) instead of the 14,79 tax increase. In other words, a net difference of 20,56 EUR per month or 246,72 EUR per year!

Safe for 2024, but what about 2025?

Although most employees will probably welcome the intervention of the government, it will only mitigate the damage for this year.

Based on the figures of the Belgian car federation Febiac and Mobia, the expected share of full electric cars in the new registered vehicles expected for 2024 will exponentially increase to 60%.

If from this base we simulate the estimated average CO2 emission in line with the values of last year, we would land probably a bit below 40 g/km (vs. 78 g/km for 2023). This would bring the reference values to resp. 38 g/km and 31,6 g/km.

Provided no changes are made to the legislation, for our employee in the example, this means an estimated increase of his monthly tax on the benefit in kind to 190,64 EUR per month or an increase of almost 25%!

(Simulation based on a petrol car with a catalogue value of 41.000 EUR and a CO2 emission of 143 g/km, a fictitious car based on a popular company car model.)

This significant increase will also indirectly have an impact for the employers, as part of the benefit in kind is used to determine the tax deduction at corporate level.

The above case demonstrates that the mobility landscape has become increasingly complex, with many variables influencing the cost for both employer and employee. Should you have any questions on the above, or would be interested in simulating your fleet cost for the coming years, don’t hesitate to contact your regular PwC contact person or Pieter Nobels / Matthias Vandamme.