The 10% capital gain tax

As of January 1, 2026, as per the new (draft) article 90, 9° c) of the ITC 92, capital gains realised upon the disposal of financial assets -beyond the scope of a professional activity but within the scope of the normal management of the private estate – will be taxed at 10% where they exceed 10.000 EUR. The exempt quota of 10.000 EUR may be carried forward up to a maximum of 1.000 EUR/annum for maximum 5 years (so a maximum exempt quota of 15.000 EUR).

Financial assets include financial instruments, some insurance contracts, crypto assets and currencies.

“Internal” capital gains on shares

Separately, as per the new (draft) article 90, 9° a) of the ITC 92, capital gains realised upon a sale of shares by an individual who alone or together with his close relatives controls the acquiring company would be taxed at 33% +local taxes (“interne meerwaarde”/ “plus-values interne”).

Substantial shareholdings

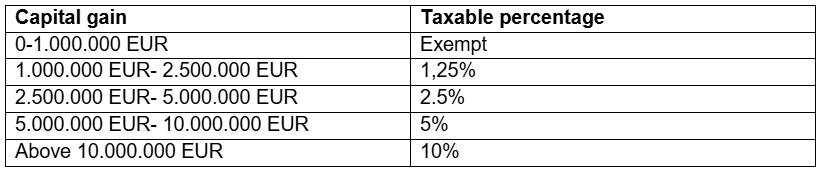

Under the new (draft) article 90, 9° b) of the ITC 92, the capital gain realised upon a disposal of shares by an individual who hold 20% of the shares of the company would be exempt up to 1.000.000 EUR and then taxed at graduated rates as follows:

However, where it comes to the disposal of a substantial shareholding in a Belgium tax resident company to a non-EEA company, the capital gain would be taxable at 16.5% (plus local taxes).

Capital gains on investments falling beyond the scope of the normal management of the private estate (article 90 1° ITC 92)

Where it goes about capital gains realised on financial assets falling beyond the scope of a professional activity and the normal management of the private estate they would be taxed as miscellaneous income at 33% (plus local taxes) under article 90, 1° of ITC 92.

Base cost used to compute the capital gains on financial assets accrued as of January 1, 2026

The new capital gain tax would only apply to capital gains on financial assets accrued as of January 1, 2026.

To compute the taxable capital gains, the base cost of a financial asset acquired prior to January 1, 2026, would be its value measured on December 31, 2025.

For listed financial assets, the base cost will be its last closing price in 2025.

For unlisted assets, the base cost will be the higher of:

- the value at which the financial asset has been disposed of for a valuable consideration in 2025 between independent parties, or, where it comes to shares, their subscription price at the occasion of a capital increase or the incorporation of the company where they occurred in 2025;

- the value arising from a valuation formula included in a contract or put option in force on January 1, 2026;

- where it comes to shares and share related instruments, the equity value of the company increased by 4 x EBITDA as per the last financial statements prior to January 1, 2026 (with the possibility for the taxpayer to use as base cost the value of the instruments on December 31, 2025 as determined by an auditor, who is not the statutory auditor, or an independent chartered accountant by December 31, 2026 at the latest).

- For disposals occurring up to December 31, 2030, the taxpayer may request that the base cost of the financial asset is its actual acquisition cost (as documented by the taxpayer).

It is important to note that, capital gains on financial assets realised beyond the scope of the normal management of the private estate whether accrued as of January 1, 2026, or prior to January 1, 2026, will be taxed at 33% + local taxes under article 90, 1° of ITC.

Exit tax

Where Belgium tax resident individuals transfer their place of residence outside of Belgium, they will be subject to an exit tax. The exit tax would apply to the capital gain accrued up to the transfer of the tax residence if the assets are disposed of within the two years. An automatic deferment of payment of the exit tax applies if the individual transfers their tax residence in the EU, the EEA or a country with which Belgium has a double tax treaty providing for the exchange of information and mutual assistance in recovery of taxes.

In the same spirit, where a non-resident taxpayer moves to Belgium the base cost of the financial assets “imported” to Belgium will be the value of the financial assets at the time the taxpayer moves to Belgium.

Income tax withholding

The capital gain tax is expected to be levied by Belgian intermediaries unless the taxpayer has opted out. Where it comes to transactions not involving Belgian intermediaries, the capital gain will have to be reported in the individual tax return. Where the capital gain tax levied at source exceeds the final CGT due, the excess should be claimed back through the individual tax return.

Notification duty

The law also introduces a ‘DAC 6’ like reporting obligation for those who are involved in relation to a transfer of a substantial shareholding or “internal” capital gains on shares. The reporting obligation resembles the already existing ‘DAC 6’ reporting as implemented in Belgian law. This reporting obligation would need to be complied with no later than the last day of February the year following the year the operation was carried out.

Next Steps

While the draft legislation still needs to go through the legislative process and is still subject to possible changes, it clear that the tax technical and administrative complexity should not be underestimated.

Don’t hesitate to reach out to your regular PwC contact for a first assessment or more clarification especially

- With the possible application of envisaged exemptions and exceptions

- With the preparation of future reporting obligations which requires a more diligent personal administration

- When preparing for a future transaction especially in the context of a family business or start-up context

- When looking for more comfort in terms of valuation of your business

- When participating or considering the launch of equity-based incentive plans